I’m back listening to the Dave Ramsey podcast at the moment, paying attention to his words of wisdom – and I’m not being totally sarcastic when I say that. This morning, he rang a bell by saying “When it comes to running your own business, there are three rules. Everything will cost twice as much as you expect, everything will take twice as long as you think and the third rule is that you aren’t the exception to the rules.”

Dave would kick my ass all around the room about my current budget and planning, I think. Mind you, I once heard him advise a bloke to save and invest in a way that meant he’d have $8m in the bank by the time he was 85 – for what?! Cocaine and hookers, you’d hope, but Dave, being a bit weirdly religious, isn’t going to advise that.

So why would he kick my ass? Because, at the moment, I seem to spending way more than my income generates on a monthly basis. In fact, I’m gobsmacked myself at the way money seems to be hemorrhaging out of my account in the last few months. This is mostly to do with the house, where unforeseen expenses have recently been slapping me around the head. Firstly, our ceiling fell in due to mice nibbling through the plastic elbows that connect our copper water pipes which run through the floor space between our ground floor and upstairs. “Insurance job”, I thought, which is when I found out I’d taken a £600 excess on the policy and the repair cost was £700. Deep sigh. I had it repaired and, two weeks later, it happened again. Same thing, so not only had I the repair to fund again, I had to get a professional pest controller out to help me find where the little buggers were getting in.

Next thing was the mower. The first grass cut of the year and I just couldn’t get the fifteen year old brute to start. I’d serviced it myself twice last year (thanks to Youtube), but I couldn’t face another summer of fighting with it when £350 would buy me peace of mind in a new mower with a Honda engine. So I shelled out for that too.

Next thing, a real horror story when our pressurised water tank gave up the ghost. No, our insurance wouldn’t cover it and it was just out of its twenty year warranty. It had to go. I’m still waiting for the bill, but there will be no change out of three grand.

There’s a screed of other things that need done to the house too, some of which I can do myself but some which I need to get the professionals in for. For example, I could paint the outside of the house, the decking and the fence, but I might die of boredom if I try. And I don’t fancy risking really dying falling off a ladder trying to get to our top windows either. So I’m budgeting £1,000 for that lump of work.

Then there’s the garden which, given the work I need to do in it, will necessitate a fair amount of spending too. There’s brickwork, which I haven’t the first idea how to attempt, and I have to rebark all the garden flower beds (it’s quite a big area) adding to costs that I know I will incur. I could also do with replacing the garden shed, which is rotting away, but I’m drawing the line at that on the basis that it’s still currently standing. There’s always alternatives to spending money on the garden – it would be fine if I just tidied it up, really – but I’ve been following that strategy for about the last ten years. At some point you have to acknowledge that you need some help with it.

This is the sort of spending that you should plan and budget for, of course. Most of us in the FIRE community know the rules, and even although Dave Ramsey isn’t necessarily a fan of the RE bit, I can hear him demand, “You knew this would happen, Jim, so where in darnation is your emergency fund?”

“Ehrm, well, I kind of invested it, Dave”, would be my response, although that’s not entirely true. I do have cash sitting in the bank, but if you do a quick tally of the above then taking the best part of five grand out of it is not an action I relish one little bit. I was hoping to invest that little sum when the US market drops back under 20,000 points as I kind of think it eventually will. That’s now not to be.

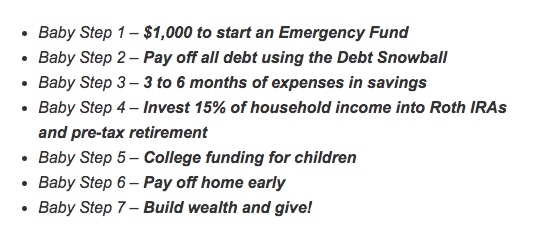

I can’t be the only one, however, who secretly sees their “emergency fund” as an asset that might never have to spent and then has a bit of petted lip when it does. Worse, I’ll have to replenish it now, which is making my petted lip pout even more. I have to admit that I really liked the idea of an “emergency fund” until the day I had to face spending it. Ironically enough, it’s often a new boiler or heating system that’s quoted as being the emergency you might have to find money for in many of the books and articles I’ve read. Discovering that this shit actually does happen in real life hasn’t been any fun at all. As ever, Dave’s rules aren’t for lightweights. He’s serious about the steps you have to take to reach “financial peace” and starting an emergency fund is Step Number One (bolstering it is Number Three.) But I’d slot in a Step 3 (a) which would read, “And do not count your emergency fund as an asset”, as it’s only going to disappoint you later in life when you have to actually spend the damn thing.

Dave Ramsey’s Baby Steps to Financial Peace

You need to retire again SHMD, then you’ll have time for all the domestic jobs 🙂

LikeLiked by 1 person

One day….

LikeLike

I keep my emergency fund and what I call “strategic cash” off the unitised portfolio section of my spreadsheet and in a high-level summary I do for this very reason. (I also try to focus on % returns on the portfolio rather than cash returns, for related reasons.)

Was similarly annoyed when I had to spend my earmarked ‘flat deposit cash’ to — er — buy a flat! 😉

But having channeled it out of the portfolio tracking over the years definitely eased things. 🙂

LikeLike

Spending money is way, way harder than saving it, especially when squirrelling away cash is something you’ve being doing for decades!

LikeLike

Bloody houses – they are so expensive to maintain

Plus cars – got a speeding ticket and an 850 repair bill to contend with today

autonomous cars can’t come soon enough, no speeding tickets, no repair bills, no depreciation, no insurance, no parking spaces – ahhh heaven..

LikeLike

makes me think of the millions of driveways across the UK rendered obsolete overnight, that little strip of private tarmac much coveted will become valueless – garages will still be useful though, everyone loves mucking about in their garage regardless of whether there’s a car in it?

LikeLike

“regardless of whether there’s a car in it”: good God, you mean you can park cars in them? That had not occurred to me.

LikeLiked by 1 person

I have a separate “emergency fund” for the car that I put some cash into every month. For years I had company cars so any problems were taken care of, but these days buying a tyre (when I never think they’re anywhere near bald!) can send me into a panic attack.

LikeLike

My emergency fund is kept separate from my ‘retirement pot’ and as I’ve had to dip into it last year, I’m topping it up bit by bit. It was at 3 x my monthly expenses but has now dipped to below 2 but ultimately, I’d like it to be at least 5 or 6. As I’m in accumulation phase, part of me is saying I should be chucking all my money at my investments but I also need the comfort and back up of my emergency fund.

LikeLike

That’s a bit I didn’t go into that adds injury to insult – not only did I have to spend my emergency fund, I now have to top it back up 😦

LikeLiked by 1 person

You are not alone Jim. I haven’t put any money into investments for a while as I keep topping up the emergency fund when something else in the home goes t**s up. The rule is to allow 1% of the home value for repairs in the budget, but the repair bills don’t arrive in an orderly uniform fashion!

LikeLike

Yes, this has been a tough start to the year in my house. The plumbing I’ve needed done has been a nightmare, and it’s still not working properly (thankfully I haven’t paid the bill yet, and won’t until it’s going perfectly.)

LikeLike

“allow 1% of the home value for repairs in the budget”: my guess is that that is unrealistically low. But is my guess any good?

LikeLike

It definitely wouldn’t cover the stuff that I’ve needed done – plumbing, electrics, building work. Why didn’t I learn a trade?!

LikeLike

Oh the joys of home ownership!

This month it is car related expenses for me, a cracked windscreen (£60 insurance excess) and air con broken (~£300 quote). Queuing to be done are new brakes (they are ok at the moment but garage say they will need doing by the end of the year and a new tyre). But hey..without the car I couldn’t work as there is no public transport links joining my living location to my place of work and its too far to cycle! It’s therefore a necessary evil, in the same way that owning a house results in maintenance and upkeep.

I do wonder how the automated car scenario will play out in years to come? You don’t need a driving licence or insurance, etc? How is it going to work?

On my house list is: cleaning and painting the rendering, fixing the broken tap (still can’t find a plumber!), fix the shower (it works – sort of – but again down to finding a plumber !!) – [probably cheaper to go on a plumbing course and fix it myself ! ], re-felting the garden shed.

The list goes on and on.

LikeLike

I also have a list…..and it’s dwarfed by the one that my DOH is (constantly) working on.

LikeLike

Over time dearieme setting aside 1% of a homes value a year has worked out about right for me. However like car repairs, this aspect is the most challenging to budget for. If you buy an old house that needs an overhaul or end up with a duffer of a vehicle then 1% is unlikely to suffice.

LikeLike

I think, on reflection, that over time that advice is pretty good – budget 1% of your home’s value. That could be quite a substantial amount though, especially for our London and South East readers!

LikeLike

I have a flat in London and 1% a year every year would be too much because of high London prices and because the flat has proved to be very low maintenance. On the other hand my small house in Australia I live in is giving me sleepless nights. 1% would be no where near enough. It is poor built and everything is wearing out, electrics, kitchen, flooring, plumbing, bathroom, etc etc. Going to cost me thousands which will have to be added back on to the mortgage so two steps forward one step back.

LikeLike

I was going to say surely the 1% rule massively depends on where you live. I don’t see why a 3 Bedroom house in London worth say 1 million would *that* much more expensive to maintain than a 3 bedroom house in Hull, worth say 200K. Surely plumbers don’t cost 5x that in London do they!? 🙂

We’ve spent around 2-3K per year on the house so far and I can see that being around the long term average (not accounting for inflation of course).

I have to admit the day our boiler finally packs in will be a bad one, not looking forward to shelling out for that!!!

LikeLike

And you know it will pack in! We were lucky ours happened in the three days of Spring weather we’ve had so far this year, which is probably all we’ll get before winter comes back in at the end of August.

LikeLike

I think there are issues raised here worth more attention in the FIRE community. Many of us are by nature hoarders, and it gives us pleasure to watch our nest eggs grow, and pain when we have to break into them. Clearly this tendency is useful for when we need to save, but less so when we need to loosen up a bit and actually use the money we’ve carefully nurtured. Especially since there’s also a tendency to adapt or habituate to each level of wealth, so that say, £100k no longer gives you the same sense of security once you’ve amassed twice that.

I do think we have to be mindful of the risk of being the richest person in the graveyard. I once read something on a blog which I personally find really helpful in counteracting my own hoarding tendencies. It was to the effect that the purpose of money is to circulate. This is really true. Money can only truly use its power, for good or ill, when it is actually used, converted, passed on, exchanged….So I try now to see myself as simply a custodian, with money temporarily in my hands, and my job is to make the best USE of that money in the world, and not simply to watch it grow and add it all up every so often. So moving from simply HAVING money, to thinking, ok, what is this money going to DO for me, or my children, or the world in general.

I’m not suggesting we go all spendthrift. Just to be aware of where our hoarding tendencies come from (a need for security, mainly) and when they are perhaps less than helpful.

LikeLike