I received a circular from Standard Life this morning in the email, offering advice on “How to pass on your pension to your loved ones”. This, I thought, was a bit previous as I have no intention of dying anytime soon, although I grudgingly admit that at some point it may have to happen. Like Woody Allen, however, I don’t intend to be there when it does.

One of the main tips in the article was to remember to regularly review your will. My wife and I made our first will about twenty five years ago when we took out a new mortgage. I think, at the time, that we giggled our way through it at the strangeness of it all, laughing in the distant face of our assumed unlikely deaths. Oh to be young again. When we recently updated it, we weren’t quite so jocular and it seemed quite a serious exercise, simultaneously quite simple and complex as you work through various scenarios. These brought up the question of also making a Power of Attorney, which we resolved to do (and still haven’t.)

Another document we were handed to complete prepared you for things that you might like to happen upon your death – including such things as what music you’d like played at your funeral – in a Statement of Wishes. Filling that out is also still on the “To Do” list. It’s one of these things that you know you should focus some attention on but somehow find yourself not getting round to it.

I also admit that I have very little knowledge on the financial side of the death equation. I’m aware of very general points of inheritance tax – such as that it exists – but have not looked in any detail whatsoever at the subject. I’m probably telling myself that I’ve got years, nay decades, to look into all of that. Another general thing I tend to think of is the scenario that I’ll go first, leave everything to my wife, and then she can sort it all out. (That actually happened to a friend who had his own business, with disastrous results.)

I am aware of the importance of “putting your affairs in order” on a hypothetical basis at least, as I bet many of us are. Actually “putting our affairs in order”l takes a bit of work and might not seem the most appealing thing to do, but at some point will need to be done. It also seems obvious that this should happen while you’re still in sound mind to do it. It surprised me, when I sat down to review the contents of our first will, that we immediately wanted to change a few things in it. I had kind of assumed we’d just be rubber stamping things that we’d previously requested, but it didn’t turn out that way. There were no drastic changes, but the exercise caused us to think things through that, decades ago, had seemed straightforward. Bottom line was that over the years your circumstances change, but so do your attitudes toward them.

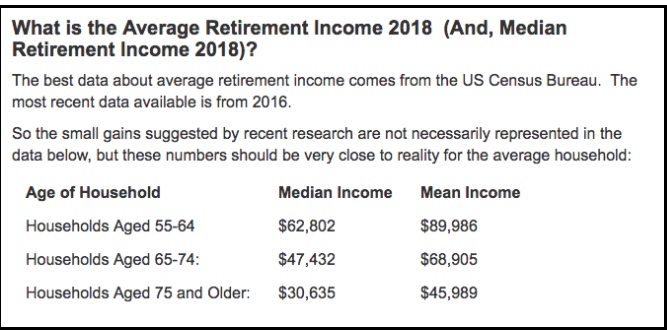

In the end it’s the reality of the Grim Reaper that stands behind many of the decisions that we make today. For starters, at what point do you end your spreadsheet modelling for retirement? Does it just kind of fade away as you approach your nineties? Or have you had a stab at filling out one of those on-line calculators that give you an actuarial Estimated Departure Time? For me, it’s one of the big unanswerable questions that frustrates when trying to work out your pension plans – how long do you need your funds to last? Should you spend more in your Sixties than you plan to in your Eighties? The answer to that would seem an obvious “Yes”, leading to the next question of “How much more”? It’s all very well planning to “Die With Zero” only to find that you actually have to “Live With Zero” because you got some assumptions wrong. (I’m sure that book tackled this issue and gave you some strategies for it. But, as I’ve mentioned, hypothesising is easy.)

And so, at last, I’ve managed to write a blog entry about Death! Only Sex to go, and I will have finally delivered on the promise of my title.